Introduction

In the realm of finance and business, security bonds play a crucial role in ensuring that transactions are secure and reliable. One company that has made significant strides in the bond industry is Swiftbonds. They benefits of performance bonds provide various bonding services that cater to diverse needs, from contractors to individuals seeking financial assurance. This article aims to address common questions about Swiftbonds and their services, offering clarity on how these bonds operate and why they might be essential for your financial dealings.

What is a Security Bond?

Definition of a Security Bond

A security bond is essentially a promise made by one party to another, where the first party guarantees the fulfillment of certain obligations or conditions. This can include financial responsibilities, adherence to contractual terms, or compliance with legal requirements. In practical terms, if the obligated party fails to meet their commitments, the bond provides compensation to the affected party.

Types of Security Bonds

Security bonds can be categorized into several types:

- Contractor Bonds: Often required for construction projects, these ensure that contractors will complete their work according to specified standards. License Bonds: These are necessary for businesses needing licenses to operate legally within certain industries. Court Bonds: These include appeal bonds and guardianship bonds which are used in legal settings. Fidelity Bonds: Protects against employee dishonesty.

Understanding these types is crucial when considering what kind of bond you may need from Swiftbonds.

Why Are Security Bonds Important?

Security bonds serve as a safety net for many transactions. They protect clients from potential losses due to non-compliance or unfulfilled agreements. For instance, if a contractor fails to complete a project, the bond ensures that funds are available to rectify the situation.

Common Questions Answered About Swiftbonds and Their Services

When dealing with any service provider, especially in finance, it's natural to have questions. Here’s an overview of some common inquiries about Swiftbonds:

1. What Services Does Swiftbonds Offer?

Swiftbonds provides a range of bonding solutions tailored for both individuals and businesses. Key offerings include:

- Performance Bonds Payment Bonds Bid Bonds Commercial Surety Bonds Fidelity Bonds

Each service is designed with specific needs in mind, making it easier for clients to find what suits them best.

2. How Can I Apply for a Bond Through Swiftbonds?

Applying for a bond with Swiftbonds is straightforward:

It's worth noting that having your documents ready can expedite this process significantly.

3. What Are the Costs Associated with Security Bonds?

The cost of obtaining a security bond varies based on several factors:

- The type of bond needed The amount covered by the bond Your creditworthiness

Generally speaking, expect rates between 1% to 15% of the total bond value.

4. How Long Does It Take To Get Approved?

Most applications are processed quickly—often within one business day—if all necessary documentation is provided upfront. However, certain complex situations may require additional time for underwriting.

5. What Happens If I Default on My Bond?

If you fail to fulfill your obligations under a bonded contract:

The affected party can file a claim against your security bond. If proven legitimate, the surety (bonding company) will compensate them up to the bond amount. You will then be responsible for reimbursing the surety company.This process emphasizes why choosing reliable bonding services like those offered by Swiftbonds is vital.

6. Does Swiftbonds Offer Customer Support?

Absolutely! Swiftbonds prides itself on excellent customer support through various channels including phone, email, and live chat on their website during business hours.

Understanding Different Types of Bonds Provided by Swiftbonds

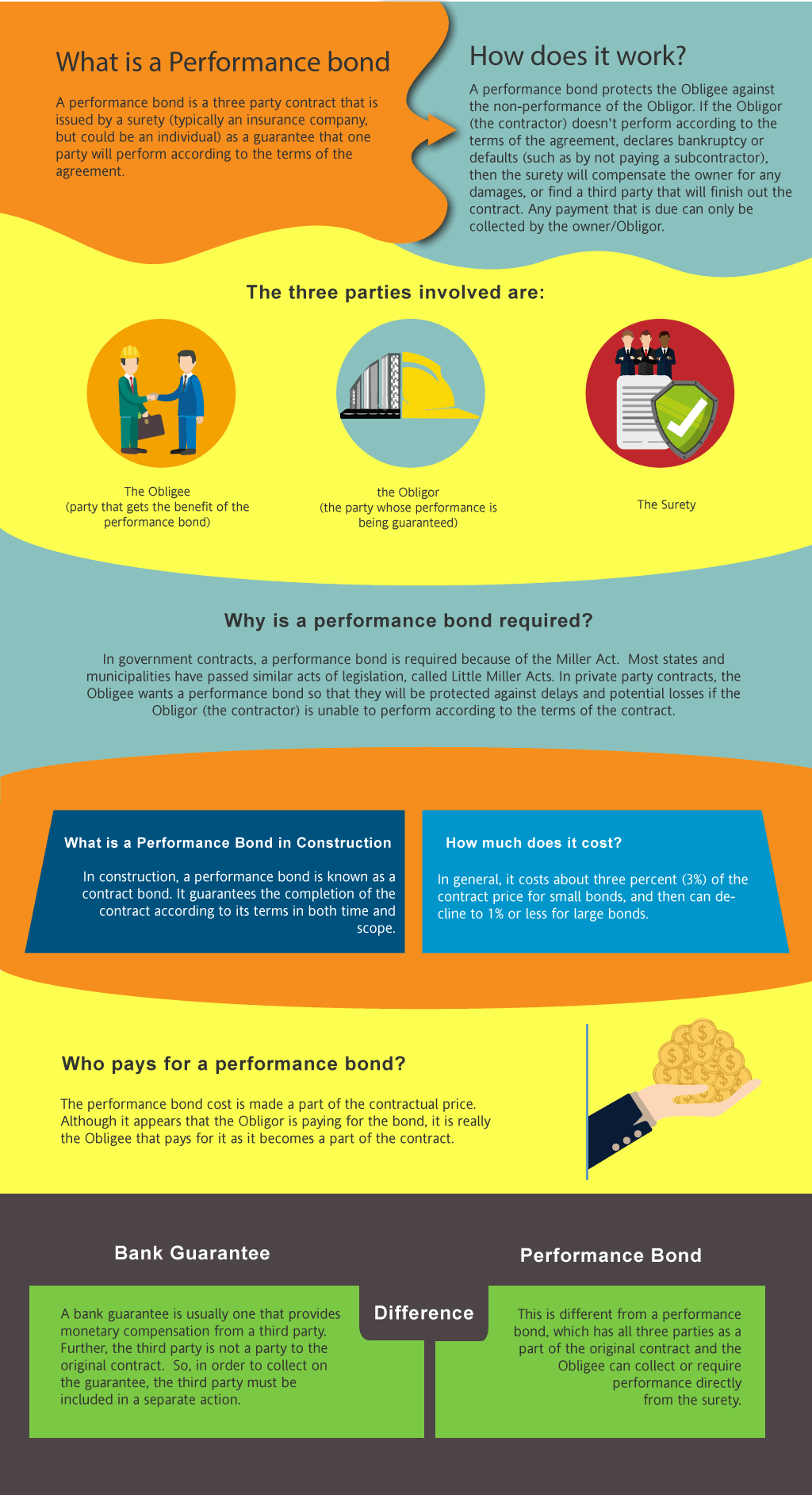

Performance Bonds Explained

Performance bonds ensure that contractors fulfill their contractual obligations satisfactorily. They protect project owners from contractor defaults and guarantee project completion as per agreed standards.

Benefits of Performance Bonds

Financial Protection Increased Credibility Compliance AssurancePayment Bonds Overview

Payment bonds guarantee that subcontractors and suppliers will be paid even if the primary contractor defaults on payments.

Importance of Payment Bonds

Enhances Trust Among Stakeholders Minimizes Legal Complications Ensures Smooth Project ExecutionBid Bonds Deep Dive

Bid bonds are often required during competitive bidding processes; they assure project owners that bidders are serious about executing contracts if awarded.

Key Features of Bid Bonds

Financial Commitment Assurance Encourages Serious Bidders Protects Against Non-completion RisksAdditional FAQs Regarding Quick Access Services at Swiftbonds

How does credit rating affect my ability to secure a bond?

Your credit rating plays an important role in determining whether you'll qualify for certain bonds and at what rate you'll pay premiums.

Can I get bonded with bad credit?

Yes! While bad credit may result in higher premiums or specific limitations on types or amounts of bonds available; alternative options exist at Swiftbonds aimed at accommodating various credit profiles.

Do I need collateral for my security bond?

Typically not; most customers qualify without needing collateral unless they're high-risk applicants needing special considerations due diligence checks from lenders will determine this case-by-case basis!

Conclusion

Navigating through bonding services can feel overwhelming given its technical nature; however understanding core concepts like security bonds empowers you when making informed decisions regarding financial commitments within any industry or endeavor!

Swiftbonds stands out as an invaluable partner providing comprehensive support throughout every phase—from initial application through ongoing assistance after securing necessary coverage—ensuring peace-of-mind knowing you’re protected against uncertainties ahead!

By addressing common questions surrounding "Common Questions Answered About Swiftbonds and Their Services," we hope this article enlightens your understanding while helping you harness all benefits offered by such essential tools across varied professional landscapes!