Introduction

In the ever-evolving landscape of financial services, the surety bond industry stands out as a vital component that guarantees the performance and integrity of various projects and agreements. As businesses navigate through uncertainties, understanding how market trends influence surety bonds becomes imperative. This article delves deep into "How Market Trends are Shaping the Future of Surety Bonds," analyzing emerging patterns, technological advancements, and economic factors driving this essential sector forward.

How Market Trends are Shaping the Future of Surety Bonds

Surety bonds serve as a safety net for projects across diverse industries, including construction, service contracts, and licensing. The dynamics surrounding these bonds are changing rapidly due to several market trends.

Economic Factors Influencing Surety Bonds

The economy plays a pivotal role in determining the demand for surety bonds. When economic growth is robust, businesses are more likely to invest in projects that require bonding. Conversely, during economic downturns, securing bonds can become challenging.

1. The Impact of Inflation on Surety Bonds

Inflation affects construction costs and project timelines. Higher material costs can lead to increased bond amounts, compelling insurance bond companies to adjust their underwriting criteria.

2. Interest Rates and Surety Bond Pricing

Interest rates heavily influence the pricing structures of surety bonds. Lower interest rates often lead to decreased bond premiums, encouraging businesses to secure bonds for new ventures.

Technological Advancements in Bonding Solutions

Technology has revolutionized many sectors, including insurance and bonding services.

1. Digital Platforms for Bond Procurement

Insurance bond companies are increasingly utilizing digital platforms that types of surety bonds streamline the bonding process. These platforms offer quick quotes and easy access to multiple bonding options.

2. Data Analytics in Risk Assessment

The integration of data analytics enables insurance bond companies to evaluate risks more accurately, leading to better pricing models and quicker approvals.

Regulatory Changes Affecting Surety Bonds

With changing regulations come shifts in how surety bonds operate within various industries.

1. Compliance Requirements for Contractors

New laws may impose stricter compliance requirements on contractors seeking surety bonds, affecting their ability to secure necessary funding for projects.

2. Environmental Regulations and Their Impact on Bonding

As environmental regulations become more stringent, companies may need additional bonding capacity to address potential liabilities related to environmental risks.

Market Segmentation Trends in Surety Bonds

Understanding which segments of the market require bonding services helps insurance bond companies tailor their offerings effectively.

1. Construction Industry Demand for Surety Bonds

The construction industry remains a primary consumer of surety bonds due to its inherent risks. Market trends indicate an increasing demand for performance bonds among contractors working on government projects.

2. Emerging Sectors Seeking Surety Bonds

Beyond traditional sectors like construction, emerging industries such as renewable energy are beginning to recognize the importance of securing surety bonds for project financing.

Customer Behavior Trends in Securing Surety Bonds

How businesses approach securing surety bonds is evolving alongside market needs.

1. Preference for Customization Over Standardization

Today's clients prefer customized bonding solutions tailored specifically to their project requirements rather than one-size-fits-all options offered by insurance bond companies.

2. Increased Focus on Customer Experience

Customers today expect seamless interactions with service providers; thus, insurance bond companies must prioritize user-friendly processes throughout the bonding experience.

Globalization's Role in Shaping Surety Markets

As businesses expand internationally, they face unique challenges regarding compliance and risk management related to sureties.

1. Cross-Border Transactions and Bonding Needs

International projects often require additional layers of complexity when it comes to obtaining necessary sureties due to varying regulatory standards across borders.

2. Cultural Considerations in Bonding Practices

Cultural differences can significantly influence how businesses perceive risk management strategies like sureties when operating in foreign markets.

Future Predictions: What Lies Ahead for Surety Bonds?

Understanding future trends is crucial for stakeholders wanting to remain competitive within this industry landscape.

1. The Rise of Blockchain Technology in Bonding Processes

Blockchain technology promises increased transparency and efficiency in managing contracts tied with sureties—leading us toward a more streamlined future that could fundamentally reshape current practices within this field.

2. Sustainability Initiatives Driving Change

As sustainability becomes increasingly important across all sectors—including construction—sureties will likely evolve alongside these initiatives by addressing environmental concerns within their frameworks through innovative solutions or added coverages designed specifically around sustainable practices adopted by contractors today!

FAQs

Q1: What are surety bonds?

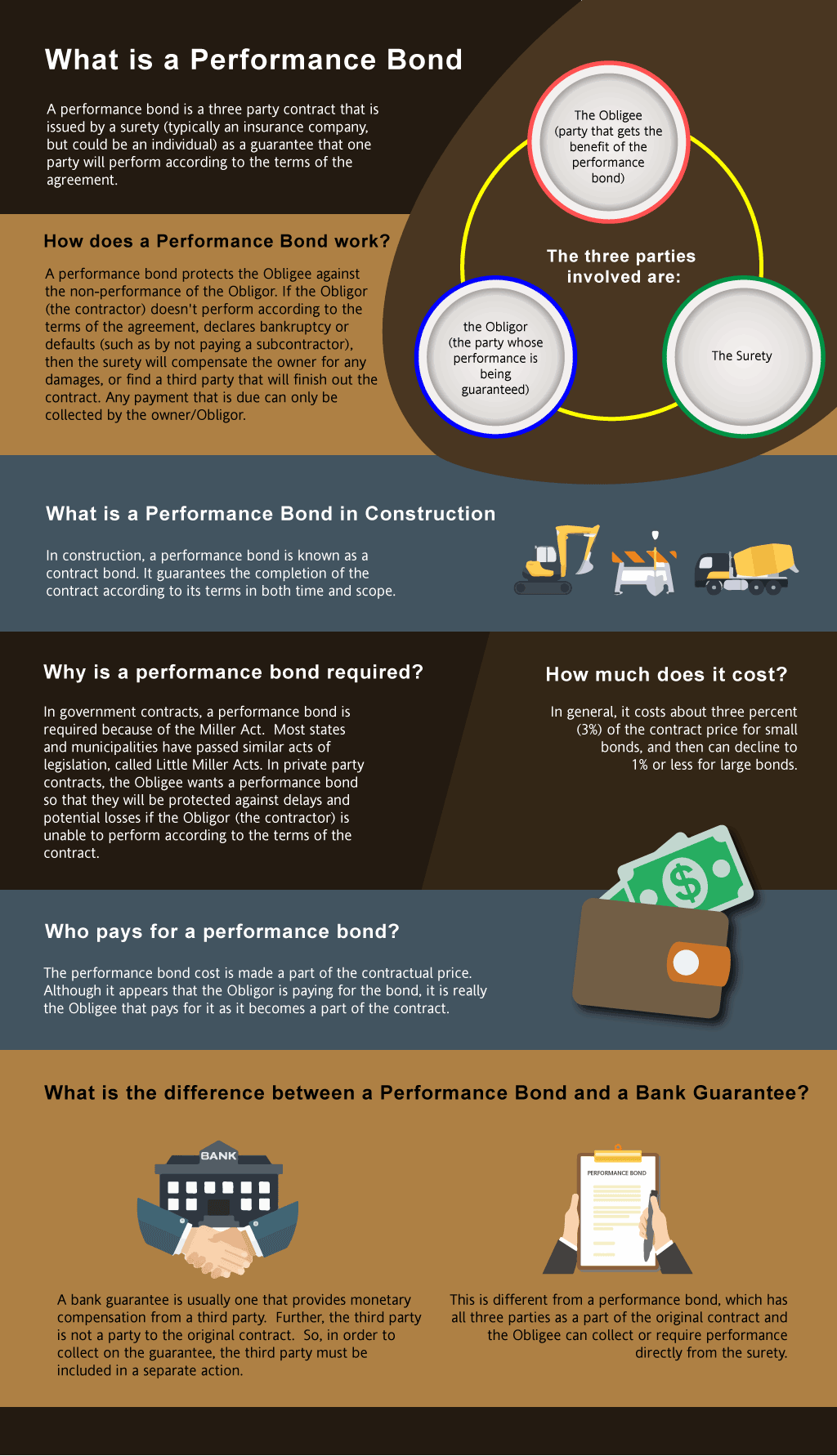

A: Surety bonds are contractual agreements where one party guarantees that another party will fulfill an obligation or contract’s terms (e.g., completing a construction project).

Q2: How do I obtain a surety bond?

A: To obtain a surety bond, you typically need to apply through an insurance company specializing in bonding services—providing required documentation such as financial statements or credit history may be necessary depending on your specific needs!

Q3: What industries commonly use surety bonds?

A: Common industries include construction (performance & payment), service contracts (janitorial & cleaning), licensing (professional licenses) among others needing assurance against failures/delays while fulfilling agreements made!

Q4: Are there different types of surety bonds available?

A: Yes! There exists several types including bid bonds (for bidding purposes), performance & payment bonds (protect against non-completion & unpaid suppliers) along with maintenance & license/permit types too!

Q5: Can I get bonded if I have bad credit?

A: While having bad credit may complicate matters—it’s still possible! Some specialized insurers might offer flexible options catering towards higher-risk applicants so don't hesitate reaching out directly!

Q6: How do market conditions affect my ability to secure a bond?

A: Economic fluctuations impact both pricing structures set forth by insurers while also influencing overall demand levels seen across various sectors needing coverage—staying informed about these trends will help ensure you’re prepared accordingly!

Conclusion

In conclusion, navigating through "How Market Trends are Shaping the Future of Surety Bonds" requires understanding intricate details concerning economic factors influencing demand alongside examining technological innovations driving efficiency improvements seen currently within this sector today! As we move forward into an increasingly interconnected global economy shaped by shifting regulations—insurance bond companies must adapt swiftly capitalizing upon emerging opportunities while also remaining vigilant about potential challenges arising from these dynamic environments we find ourselves operating amidst!