Introduction

In the construction industry, navigating contractor bonding requirements is crucial for ensuring project success and safeguarding your business interests. Whether you’re a seasoned contractor or just starting, understanding these requirements can mean the difference between winning a contract and losing out to competitors. The world of contractor bonding might seem daunting at first glance, but with the right information and guidance, you can successfully maneuver through it.

In this comprehensive guide, we’ll delve into everything you need to know about contractor bonding requirements. From understanding different types of bonds to tips for securing them and common pitfalls to avoid, we’ve got it all covered. Let’s embark on this journey together!

Understanding Contractor Bonding Requirements

What Are Contractor Bonds?

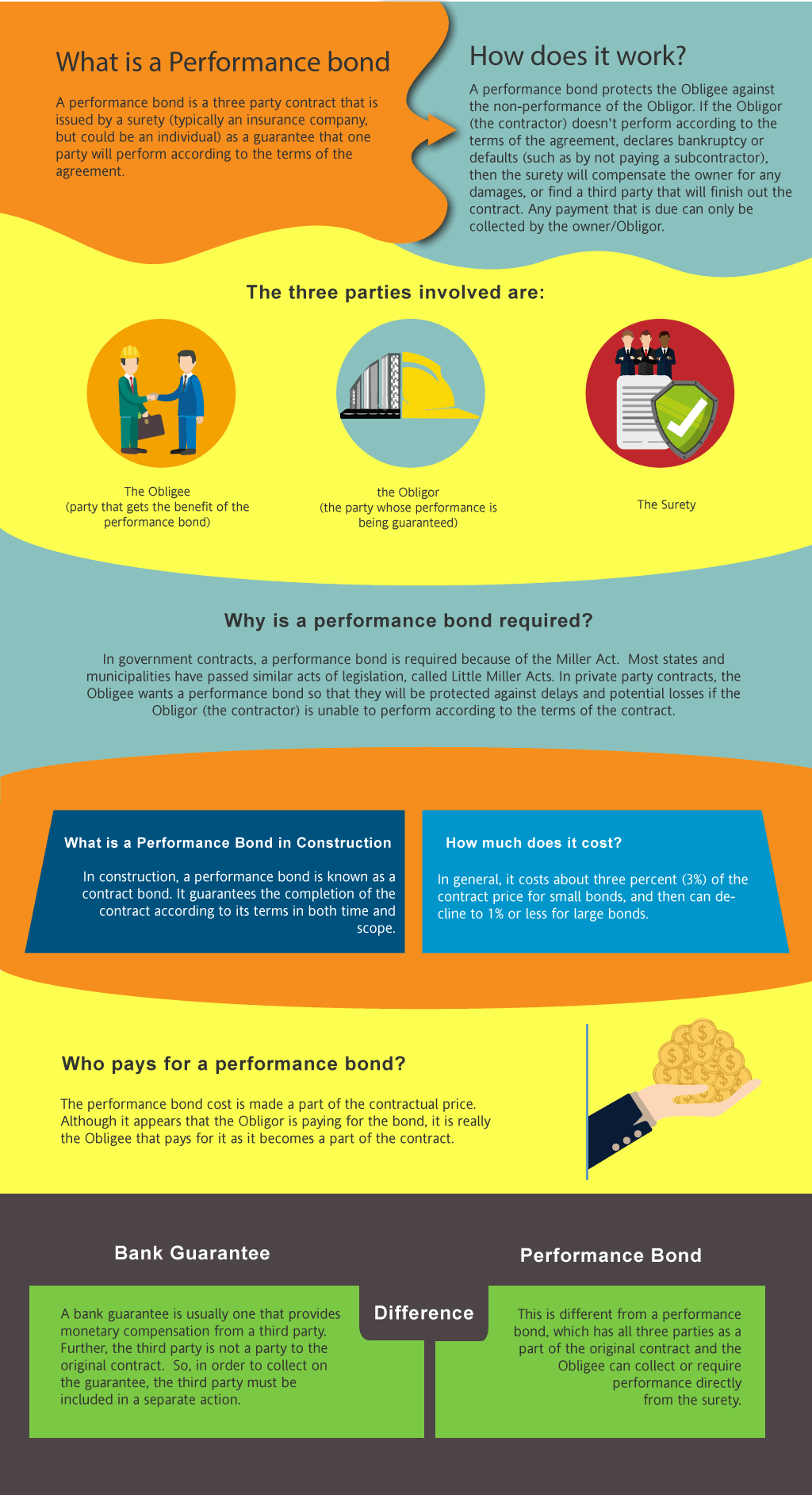

Contractor bonds are a form of surety that ensures contractors complete their work in accordance with contractual obligations. They serve as a financial guarantee that protects project owners from losses incurred due to contractor failures or disputes.

Why Are Contractor Bonds Important?

Contractor bonds are essential for several reasons:

- Protection: They protect clients against financial loss due to a contractor's failure. Credibility: Having a bond enhances a contractor's credibility and trustworthiness. Legal Compliance: Many states require contractors to be bonded as part of licensing requirements.

Types of Bonds in Contractor Work

1. Performance Bonds

Performance bonds guarantee that the contractor will fulfill their contractual obligations. If they fail to do so, the bond issuer will cover any resulting financial losses.

2. Payment Bonds

Payment bonds ensure that subcontractors and suppliers get paid, even if the main contractor defaults on payments.

3. Bid Bonds

Bid bonds are submitted during the bidding process and assure the project owner that the bidder is serious about undertaking the contract.

4. Maintenance Bonds

These bonds guarantee that the contractor will maintain and repair their work for a specified period after completion.

Key Terminology in Bonding

Understanding key terms related to contractor bonding can help demystify the process:

- Principal: The contractor who is obtaining the bond. Obligee: The party requiring the bond (usually the project owner). Surety: The company that issues the bond and guarantees performance.

Navigating Contractor Bonding Requirements: Tips for Success

Research Your Local Laws

Laws regarding bonding vary by region. It’s vital Go to this website to research local regulations concerning contractor bonding requirements before pursuing contracts.

Determine Your Bonding Needs

Evaluate which types of bonds you’ll need based on your projects’ scope and client demands. Different projects may require different bonding types.

Find a Reputable Surety Company

Choosing a reliable surety company is key in navigating contractor bonding requirements. Look for companies with strong reputations, good customer reviews, and experience in your specific field.

Prepare Your Financials

Surety companies often require financial statements when issuing bonds. Ensure your financials are in order—this includes tax returns, bank statements, and profit-loss statements.

The Application Process

Understanding Bond Applications

When applying for bonds, you'll need to fill out an application detailing your business history, financial status, and project specifics.

Documents Required

Prepare essential documents such as:

- Business licenses Financial statements Project details Credit reports

Tips For A Successful Application

To enhance your chances of approval:

Present complete documentation. Be transparent about past experiences. Maintain good credit standing.Cost Factors Associated with Bonds

How Are Bond Costs Calculated?

Bond costs typically range from 0.5% - 3% of the total contract amount based on various factors including:

- Type of bond Contract size Your credit history

Additional Fees You Might Encounter

Be aware of additional costs such as processing fees or premium adjustments based on risk assessments.

Maintaining Your Bond Status

Timely Renewals

Bonds often require renewal after a certain period; make sure you're on top of renewal dates to avoid lapses in coverage.

Monitoring Performance

Keep track of your performance metrics; maintaining high-quality work ensures smooth renewals and potentially lower rates over time.

Common Mistakes Contractors Make

Failing To Understand Terms

Misunderstanding bond terms can lead to costly errors; always read agreements carefully before signing.

Ignoring Credit Health

Your credit score significantly impacts your ability to secure favorable bonding rates—keep an eye on it!

The Role of Insurance vs. Bonds

While both insurance and bonds provide protection, they serve different purposes:

| Aspect | Insurance | Bonds | |-------------------|-----------------------|--------------------------| | Purpose | Protect against loss | Guarantee contractual obligations | | Claim Process | Insurance claims | Surety claims | | Premium Rates | Varies by risk | Based on credit history |

FAQs About Contractor Bonding Requirements

Q1: What is the primary purpose of a performance bond?

A: A performance bond guarantees that a contractor will complete their work according to agreed-upon terms, protecting project owners from potential losses if they fail to deliver.

Q2: Do all contractors need bonding?

A: Not all contractors are required to be bonded; however, many states mandate it for licensing purposes or specific types of projects.

Q3: How long does it take to secure a bond?

A: The timeline varies but generally ranges from one week to several weeks depending on documentation completeness and surety company processes.

Q4: Can I obtain multiple bonds at once?

A: Yes! Many contractors secure multiple types of bonds simultaneously; just ensure you meet all eligibility criteria for each one.

Q5: What happens if my bond claim is denied?

A: If your claim is denied, you may appeal or seek legal recourse depending on terms outlined in your agreement with the surety company.

Q6: How can I improve my chances of getting bonded?

A: Maintain good financial practices, keep detailed records, strengthen your credit score, and build relationships with reputable sureties.

Conclusion

Navigating contractor bonding requirements may seem complex at first glance but arming yourself with knowledge can make all the difference in achieving success within this arena. By understanding various types of bonds available, knowing what’s needed during application processes—and avoiding common pitfalls—you'll be well-equipped not just to secure contracts but also build lasting trust with clients while enhancing your reputation within the industry!

Whether you're looking into bid bonds for upcoming projects or seeking performance assurance through maintenance agreements—remember that every step taken towards mastering these aspects puts you ahead in today’s competitive landscape! So gear up for success—it’s only a bond away!