Introduction

In the world of construction, surety bonds are an essential element that ensures projects run smoothly and legally. For contractors, understanding the intricacies of the surety bond process can be a daunting task. This guide aims to demystify this process, providing valuable insights and practical steps to help contractors navigate it effectively.

Whether you’re a seasoned contractor or just starting out, this comprehensive article will equip you with the knowledge needed to secure surety bonds confidently. Let’s dive in!

What Are Surety Bonds? Understanding the Basics

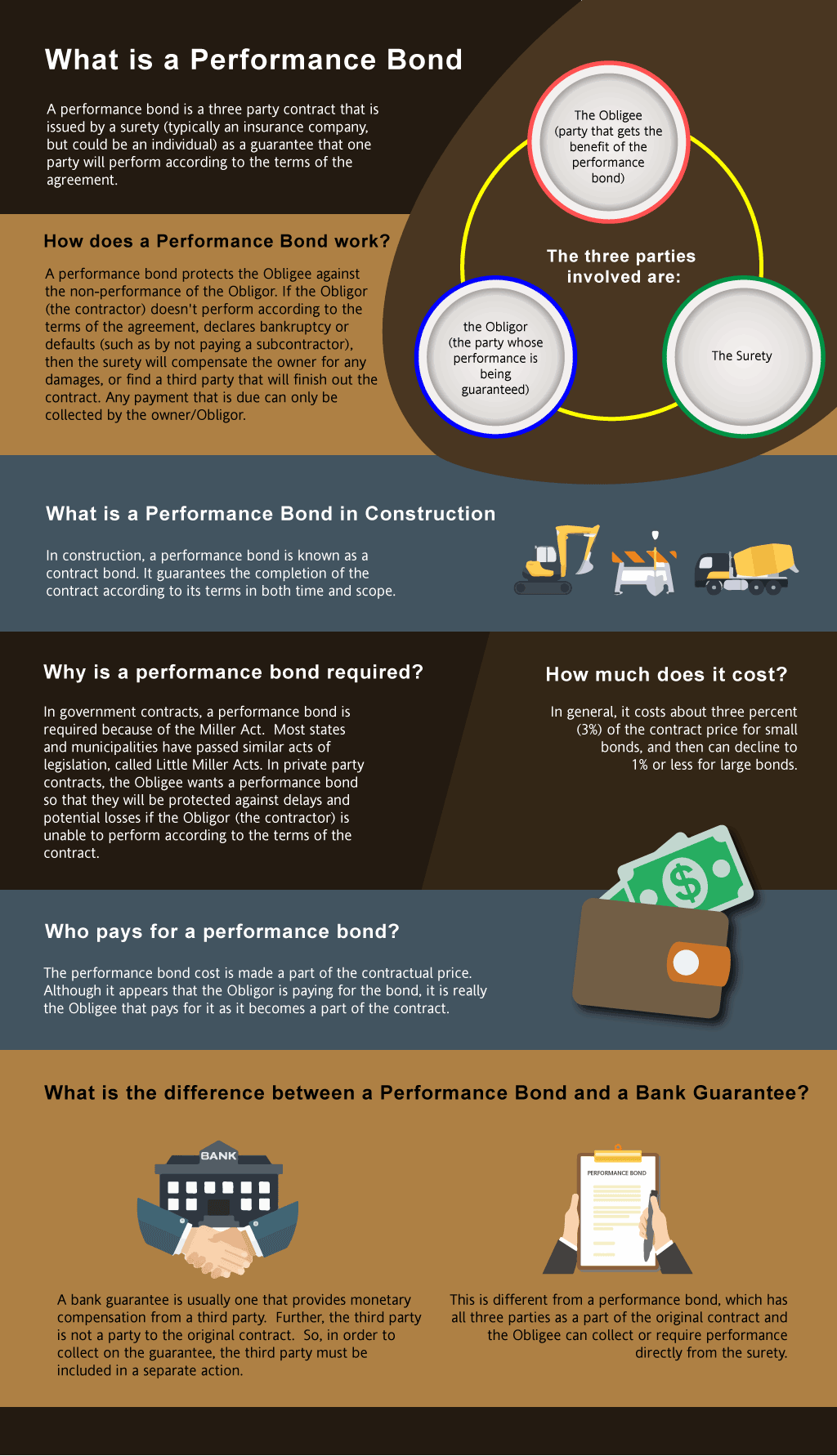

Surety bonds are legal agreements that involve three parties: the principal (the contractor), the obligee (the project owner), and the surety (the bonding company). These bonds serve as a guarantee that the contractor will fulfill their obligations as per the contract terms.

Types of Surety Bonds for Contractors

Bid Bonds: Required during the bidding process, these ensure that contractors will honor their bids if selected. Performance Bonds: These guarantee completion of a project according to agreed specifications. Payment Bonds: They ensure subcontractors and suppliers are paid for their work on a project.Importance of Surety Bonds for Contractors

Navigating the surety bond process is crucial for contractors since it often determines whether they can performance bonds secure contracts. Without a bond, many clients won’t consider hiring a contractor due to financial risks.

Navigating the Surety Bond Process: A Step-by-Step Guide for Contractors

Step 1: Assess Your Bonding Needs

Before diving into obtaining a surety bond, contractors must evaluate their specific needs based on:

- Project size Scope Client requirements

Understanding these factors will guide you in selecting the right type of bond.

Step 2: Research Bonding Companies

Not all bonding companies are created equal. Some specialize in certain types of projects or industries. Here’s how to find reputable bonding companies:

- Check Online Reviews: Look for customer feedback. Seek Recommendations: Talk to fellow contractors. Verify Credentials: Ensure they’re licensed in your state.

Step 3: Gather Necessary Documentation

Surety companies typically require several documents before issuing bonds:

- Business financial statements Personal credit reports Project details and contract copies

Preparing these documents in advance speeds up the bonding process.

Step 4: Submit Your Application

Once you’ve gathered your documentation, it’s time to submit your application to your chosen bonding company. Include all required paperwork and be transparent about your business practices.

Step 5: Undergo Underwriting Review

The bonding company will conduct a thorough review of your application during underwriting. They assess:

- Creditworthiness Financial stability Experience in similar projects

This assessment determines whether you qualify for a bond and at what cost.

Step 6: Receive Your Quote

After reviewing your application, you'll receive a quote detailing:

- The cost of the bond Terms and conditions

It’s crucial to compare quotes from multiple providers before making a decision.

Understanding Costs Associated with Surety Bonds

Factors Influencing Surety Bond Costs

Several elements affect the cost of surety bonds:

Contract Amount: Larger contracts typically result in higher premiums. Credit Score: A higher score usually leads to lower rates. Business Experience: Established businesses may qualify for better rates than new ones.Cost Examples by Bond Type

| Type of Bond | Typical Cost Percentage | |---------------------|------------------------| | Bid Bond | 0.5% - 3% | | Performance Bond | 0.5% - 5% | | Payment Bond | 0.5% - 3% |

Common Challenges in Securing Surety Bonds

Many contractors encounter hurdles when obtaining surety bonds. Here are some common challenges faced along with practical solutions:

Challenge #1: Poor Credit History

If your credit history is less than stellar, securing a bond might be challenging but not impossible.

Solution: Work on improving your credit score before applying or seek out niche bonding companies specializing in high-risk applicants.

Challenge #2: Incomplete Documentation

Submitting incomplete documentation can delay or prevent bond approval.

Solution: Double-check your documentation checklist before submission to ensure everything is included.

Benefits of Having Surety Bonds as a Contractor

Having surety bonds not only builds trust with clients but also opens doors for larger projects and enhances business credibility.

Establishing Trust with Clients

A bonded contractor demonstrates reliability—clients feel more secure knowing there’s financial backing should issues arise during project execution.

Expanding Business Opportunities

Many government contracts require bidders to hold certain types of surety benefits of performance bonds bonds; hence being bonded enables access to more lucrative opportunities within both public and private sectors.

FAQs About Surety Bonds for Contractors

What is the primary purpose of a performance bond?

The primary purpose is to guarantee that contractors complete projects according to contractual terms, protecting project owners against financial loss due to non-performance.

How long does it take to obtain a surety bond?

The timeline varies but generally takes one week if all documentation is complete and accurate; complex applications may take longer.

Can I get bonded if I have bad credit?

Yes! While it may be more challenging, many bonding companies cater specifically to contractors with poor credit histories through specialized programs.

Do I need multiple bonds for different projects?

Typically yes—each project often requires its own specific bond based on bid amounts and requirements set forth by clients or governing bodies.

Are there alternatives to surety bonds?

Alternatives exist but may not offer the same level of protection or trustworthiness as traditional sureties; options include cash deposits or letters of credit from banks.

li26/ol3/hr7hr7/##

Conclusion

Navigating the surety bond process can seem overwhelming at first glance; however, with informed strategies and preparation outlined in this guide, contractors can approach this essential aspect confidently! By understanding each step—from assessing needs through overcoming challenges—you’ll position yourself well within competitive landscapes while establishing credibility among clients through proper bonding practices!

For every contractor aspiring toward growth, mastering "Navigating the Surety Bond Process" is not just advisable—it’s vital!