Introduction

Performance bonds play a crucial role in the construction and contracting industries. Essentially, they act as a safety net for project owners, ensuring that contractors fulfill their obligations. But what are performance bonds? They are a type of surety bond that guarantees the completion of a project according to the terms of the contract. However, Swiftbonds there’s much more to performance bonds than just their definition. This article delves deep into understanding the costs associated with performance bonds, providing insights that can help contractors and project owners make informed decisions.

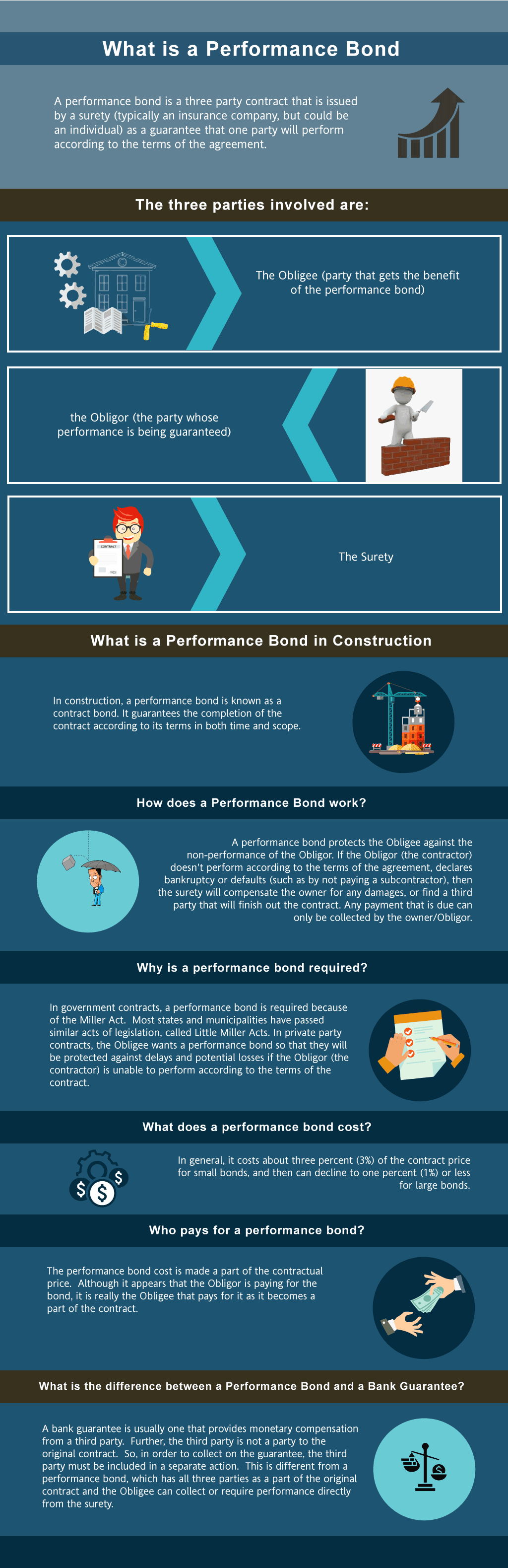

What Are Performance Bonds?

Definition and Purpose of Performance Bonds

Performance bonds are legally binding agreements between three parties: the project owner (obligee), the contractor (principal), and the surety company. The purpose of these bonds is to protect the project owner from financial losses should the contractor fail to complete the project or meet contractual obligations.

How Do Performance Bonds Work?

When a contractor bids on a project, they may be required to obtain a performance bond as part of their bid. If awarded the contract, the contractor must pay a premium to the surety company, which then issues the bond. Should any issues arise during construction, such as delays or incomplete work, the project owner can claim against this bond.

Types of Performance Bonds

Bid Bonds: Guarantee that a contractor will enter into a contract if their bid is accepted. Maintenance Bonds: Cover repairs for defects after project completion. Payment Bonds: Ensure subcontractors and suppliers are paid promptly.Understanding the Costs Associated with Performance Bonds

The costs related to performance bonds are multifaceted and can vary significantly based on several factors such as project size, risk assessment, and industry norms. In this section, we will explore these aspects Swiftbonds for your business in detail.

Factors Influencing Performance Bond Costs

Project Size and Complexity

Larger projects typically carry higher bond premiums due to increased risk.

Contractor's Financial Stability

Contractors with strong financial profiles tend to secure lower rates.

Industry Experience

A proven track record in similar projects can lead to reduced costs.

Bond Amount

The value of the bond itself plays a significant role; higher amounts mean higher costs.

Market Conditions

Economic conditions can influence surety rates; competitive markets may lower costs.

Cost Breakdown of Performance Bonds

| Component | Description | Estimated Cost Percentage | |-------------------------------|---------------------------------------------|---------------------------| | Premium | The fee paid to obtain the bond | 0.5% - 3% | | Underwriting Fees | Fees for evaluating risk | Varies | | Renewal Costs | Annual fees for maintaining active bonds | Varies | | Claims Processing Fees | Charges incurred if claims are made | Varies |

Understanding these components is essential for accurate budgeting in any construction or contracting endeavor.

Calculating Performance Bond Costs

Understanding Premiums for Performance Bonds

Performance bond premiums generally range from 0.5% to 3% of the total contract value but can vary depending on several variables discussed earlier.

Example Calculation

- For a $1 million project: At 1% premium: $10,000 At 2% premium: $20,000

Having an estimate allows both contractors and owners to plan financially accordingly.

Risk Assessment and Its Impact on Costs

Sureties assess risks meticulously before issuing performance bonds. A contractor’s credit history, previous claims, and overall experience play crucial roles in determining whether they qualify for bonding and at what cost.

The Application Process for Performance Bonds

Steps Involved in Obtaining a Performance Bond

Gather Required Documentation

Financial statements, credit reports, and references are typically needed.

Submit Application

Fill out an application form detailing your business profile and previous projects.

Underwriting Process

The surety company conducts its due diligence through interviews and evaluations.

Receive Bond Quote

Based on your profile assessment, you’ll receive your premium quote.

Sign Agreement & Pay Premium

Once satisfied with terms, sign documents and pay your premium to activate the bond.

Common Mistakes in Application Process

- Incomplete paperwork can lead to delays or denials. Misrepresentation of financial information could result in increased scrutiny or worse terms.

Frequently Asked Questions about Performance Bonds

What happens if I default on my contract?

If you default on your contract, your surety may step in to fulfill your obligations or cover losses incurred by the obligee up to the bond amount.

How long does it take to get approved for a performance bond?

Approval times vary but generally range from one day to several weeks depending on how quickly you provide necessary documentation.

Can I cancel a performance bond?

Yes, you can cancel it under certain conditions; however, cancellation may incur fees or penalties depending on your agreement with the surety company.

Are performance bonds transferable?

Typically not; once issued for one specific project or party, they cannot be transferred without reissuing through new applications.

What is collateralization in relation to performance bonds?

Sometimes sureties require collateral—cash or property—to back a portion of high-risk contracts as additional security against potential claims.

Do all contracts require performance bonds?

No; while many public contracts do require them by law, private contracts may vary based on negotiation between parties involved.

Conclusion

Understanding performance bonds is critical for anyone involved in contracting or construction projects—be it contractors seeking bids or owners protecting their investments against non-completion risks. By grasping not only what these instruments are but also how their associated costs unfold within various contexts—from application processes down through market influences—stakeholders can navigate this vital aspect of business more adeptly.

The world of performance bonds is intricate yet rewarding when approached thoughtfully—a bit like constructing a sturdy building; it all starts with solid foundations built upon understanding risks versus rewards! By keeping abreast of these details surrounding "Understanding the Costs Associated with Performance Bonds," all parties involved can ensure smoother sailing throughout their ventures moving forward.