Introduction

In the realm of business, particularly in Texas, surety bonds represent a crucial aspect of many contracts and agreements. As a safeguard for obligations and guarantees, these bonds play an essential role in ensuring that projects are completed as promised. However, one significant factor often overlooked is the cost associated with securing these bonds. This article delves into how performance bonds work "Understanding the Costs Associated with Surety Bonds in Texas," providing clarity on what these costs entail, why they matter, and how they can impact both individuals and businesses.

What is a Surety Bond?

Definition and Purpose

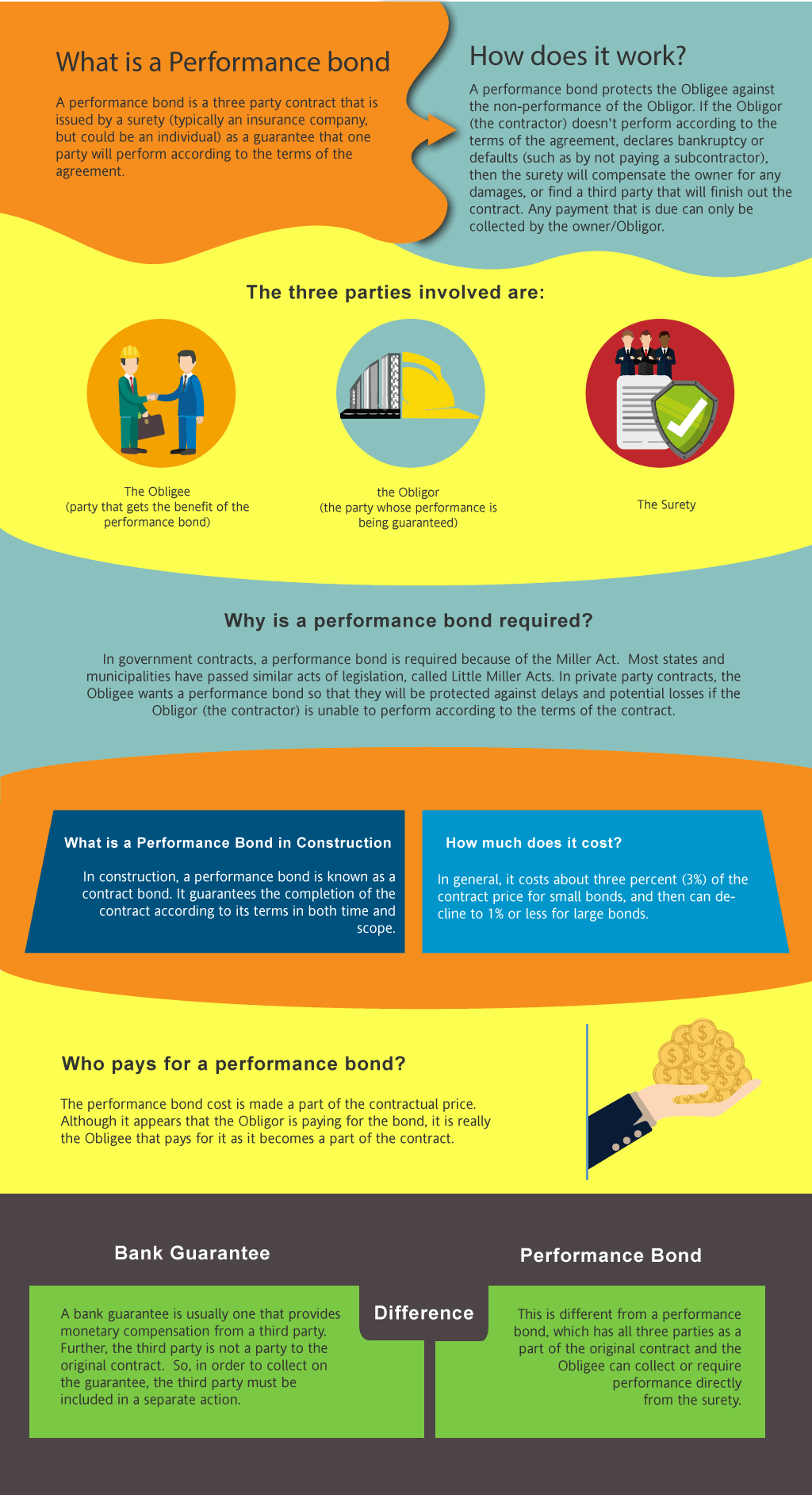

At its core, a surety bond is a three-party agreement involving the principal (the party seeking the bond), the obligee (the party requiring the bond), and the surety (the bonding company that backs the bond). The purpose of performance bonds this arrangement is to ensure that the principal fulfills their contractual obligations or compensates the obligee if they fail to do so.

Types of Surety Bonds

Surety bonds come in various forms depending on their purpose:

- Contractor Bonds: Ensures contractors complete projects according to contract specifications. License and Permit Bonds: Required for businesses to obtain licenses. Court Bonds: Guarantees payment related to court proceedings. Fidelity Bonds: Protects against employee dishonesty.

Understanding these types helps identify which bond might be needed based on specific situations.

Understanding the Costs Associated with Surety Bonds in Texas

Factors Influencing Surety Bond Costs

The costs associated with obtaining surety bonds in Texas can vary significantly based on several factors:

Bond Type: Different types of bonds have different risk profiles. Bond Amount: The total amount covered by the bond directly influences premiums. Creditworthiness: A principal’s credit score can affect rates significantly. Experience Level: Contractors with more experience generally have lower rates due to established reliability.Premium Rates Explained

Typically, premium rates for surety bonds range from 1% to 15% of the total bond amount. For instance, if a contractor needs a $100,000 bond, they may pay anywhere from $1,000 to $15,000 annually depending on their risk profile.

Additional Costs Beyond Premiums

When considering costs associated with surety bonds in Texas, it’s essential to look beyond just premiums:

- Application Fees: Some bonding companies may charge fees for processing applications. Renewal Fees: Most bonds need renewal after a certain period; anticipate these costs annually. Collateral Requirements: In some cases, especially for high-risk applicants, collateral may be required.

Understanding these additional costs ensures you budget appropriately when seeking a surety bond.

The Role of Credit Scores in Surety Bond Pricing

How Credit Scores Affect Premiums

Credit scores play a pivotal role in determining how much you will pay for your surety bond. Individuals or businesses with higher credit scores can expect lower premiums since they are seen as lower risk by bonding companies.

Improving Your Credit Score Before Applying

If you’re looking at securing a surety bond in Texas but have concerns about your credit score:

Pay off outstanding debts. Ensure timely payments on existing loans. Regularly check your credit report for errors.Improving your score could result in significant savings on your surety bond premiums.

The Application Process for Surety Bonds

Steps Involved in Obtaining a Surety Bond

To secure a surety bond in Texas, follow these steps:

Determine Your Bond Type: Identify which type of bond you need based on your project or business requirements.

Gather Necessary Documentation: Prepare financial statements, personal information (like social security numbers), and any necessary licenses or certifications.

Submit Your Application: Fill out an application form provided by your chosen bonding company along with all required documentation.

Review and Approval Process: The bonding company will evaluate your application based on creditworthiness and other factors before issuing approval.

Receive Your Bond: Once approved, you’ll receive your bond documents that outline coverage details.

Understanding this process can streamline your efforts when applying for surety bonds in Texas.

Different Surety Bond Providers in Texas

Major Companies Offering Surety Bonds

Several reputable bonding companies operate within Texas that provide various types of surety bonds:

SureTec Insurance Company Travelers Indemnity Company Liberty Mutual Insurance Company The HartfordEach provider may have unique terms and conditions; thus researching them thoroughly ensures you find one that meets your requirements effectively.

Cost-Saving Strategies When Securing Surety Bonds

Tips to Lower Costs

Here are some effective strategies you might consider implementing when seeking cost-effective solutions for surety bonds:

Shop Around! Compare quotes from multiple bonding companies. Strengthen Your Financial Standing by improving credit scores as discussed earlier. Consider Bundling Services if you require multiple types of bonds; some providers offer discounts. Maintain Industry Compliance as being up-to-date can lead to reduced risk perceptions by underwriters.Implementing these strategies could potentially save thousands over time when dealing with surety bonds in Texas.

Common Misconceptions About Surety Bonds

Clarifying Misunderstandings

It's not uncommon for misconceptions about surety bonds to circulate among potential applicants:

- Many assume all bonding companies charge similar rates; however, this isn't true—different companies assess risks differently leading to varying premium rates. There’s also a belief that once secured; no renewals are necessary—a falsehood—as most will require annual renewals or updates based on ongoing projects or changes within businesses themselves!

Being aware of such misconceptions helps clarify expectations around securing sureties effectively!

FAQs About Surety Bonds

What is the average cost of obtaining a surety bond in Texas?

The average cost typically ranges from 1% to 15% of the total bonded amount depending largely upon factors like creditworthiness and experience level within respective fields.

Are there any specific requirements needed for obtaining one?

Yes! Common requirements include providing financial statements along with proof regarding licensing/certifications tied directly towards fulfilling obligations outlined under respective contracts/projects involved!

Can I get bonded if I have bad credit?

It may be challenging but not impossible! Some providers specialize specifically catering towards higher-risk individuals who possess lower scores—though expect higher premium rates compared against those boasting solid financial standings overall!

How long does it take to process my application?

Processing times vary between providers; however generally expect anywhere from 24 hours up until several days depending upon complexity surrounding particular circumstances presented upon submission requests received during evaluations performed thereafter!

Is collateral always required when applying?

Not necessarily! Collateral only comes into play under certain conditions specifically relating towards perceived risks assessed through underwriting processes initiated prior issuance approvals granted accordingly thereafter!

What happens if I fail to fulfill my obligation under contract terms?

Should failure occur; obligees may seek compensation via means stipulated within respective contracts enabling claims made against actual issued guarantee/bond itself protecting interests involved therein regardless!

Conclusion

In summary, understanding "the costs associated with surety bonds in Texas" entails more than merely knowing what you'll pay upfront—it involves comprehending various influencing factors ranging from credit scores down through specific types sought after during applications processed throughout this journey undertaken collectively alongside various providers available today! By arming yourself with knowledge concerning everything discussed herein—from fees incurred through applications down towards strategies employed aimed at saving money along pathways traversed—you position yourself favorably while navigating complexities inherent within acquiring precious securities designed faithfully serving interests held dear across diverse industries!